Be smarter than scammers: How to outsmart cyber crooks!

Cybercriminals are constantly evolving their tactics to deceive and manipulate unsuspecting individuals. However, we believe we can work together to combat these threats.

Our aim is to create a secure environment for your financial transactions, so you can continue to enjoy the convenience of our eWallet with peace of mind. Here are the tips and tricks you can follow to strengthen your defence against scams:

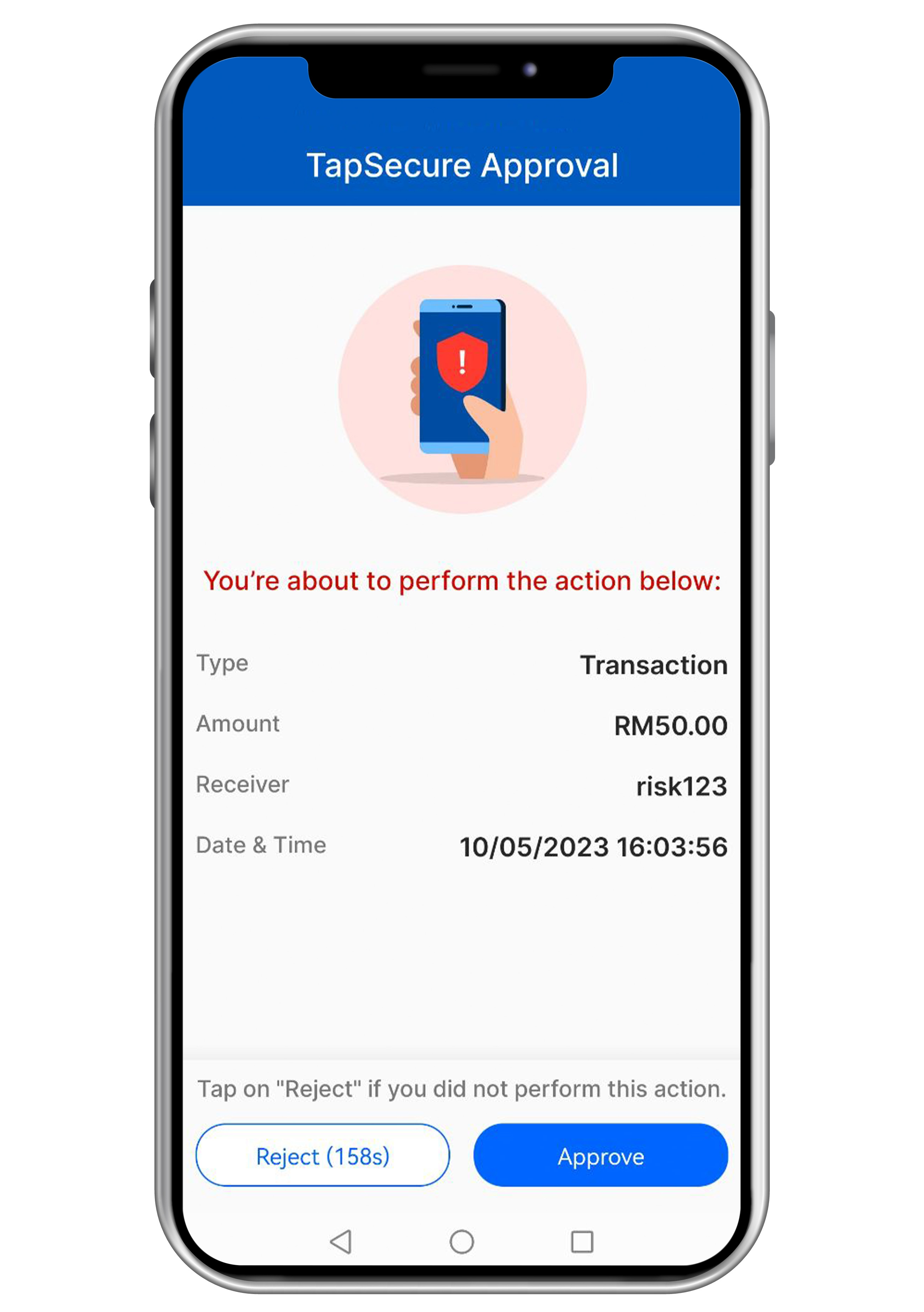

1. Verify transaction details

We have implemented TapSecure as the new security feature to approve certain transactions. Always double-check the details of any transaction and make sure the transaction is made by you before approving it.

We have implemented TapSecure as the new security feature to approve certain transactions. Always double-check the details of any transaction and make sure the transaction is made by you before approving it.

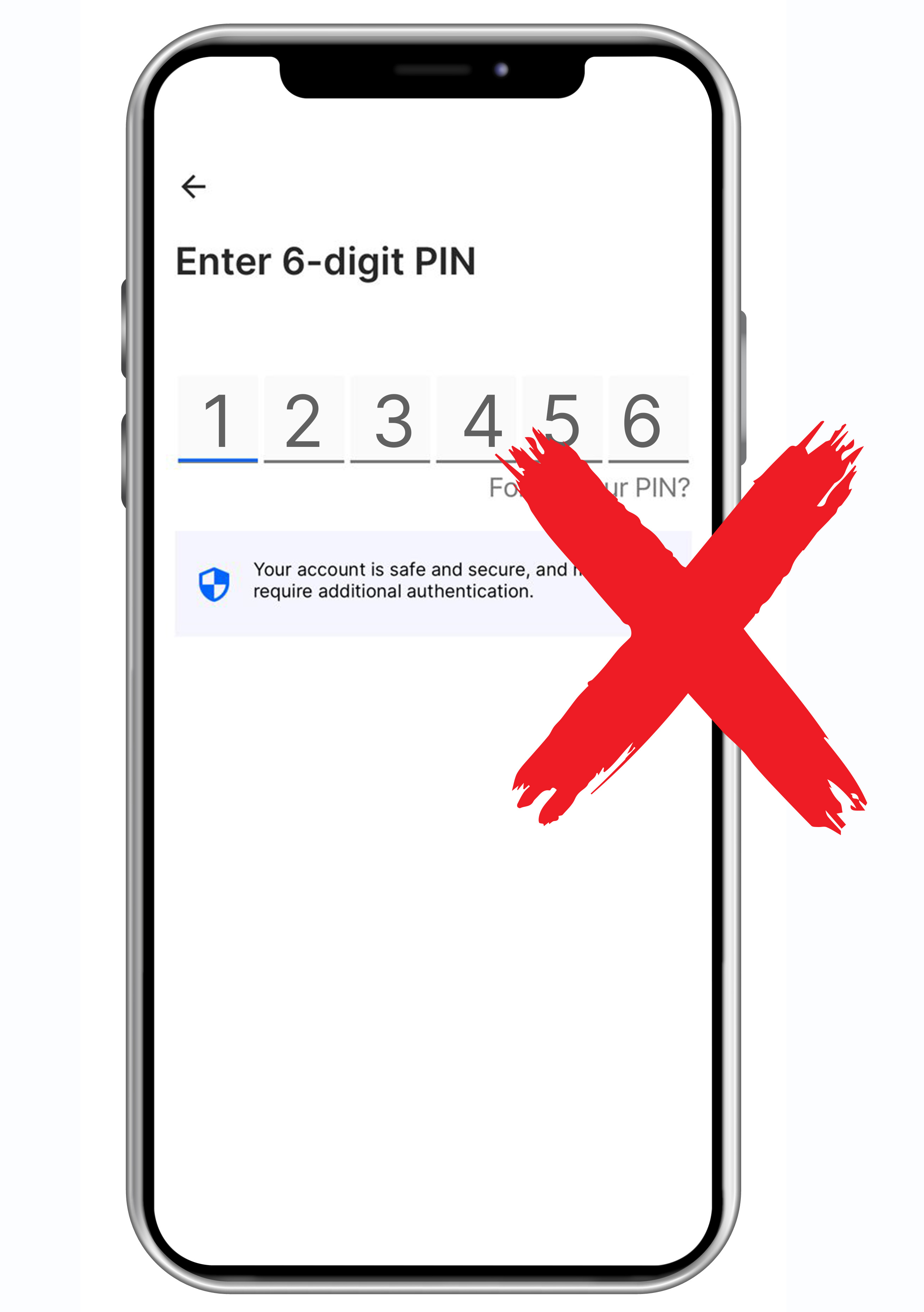

2. 123456 is not a secure PIN Create a strong PIN for your eWallet account and update it regularly. Avoid using easily guessable information like your birthdate or sequential numbers. It is recommended to use a different password for each of your accounts to minimise the risk of multiple accounts being compromised in the event of a data breach. Consider using a password manager to securely store your PIN/passwords.

Create a strong PIN for your eWallet account and update it regularly. Avoid using easily guessable information like your birthdate or sequential numbers. It is recommended to use a different password for each of your accounts to minimise the risk of multiple accounts being compromised in the event of a data breach. Consider using a password manager to securely store your PIN/passwords.

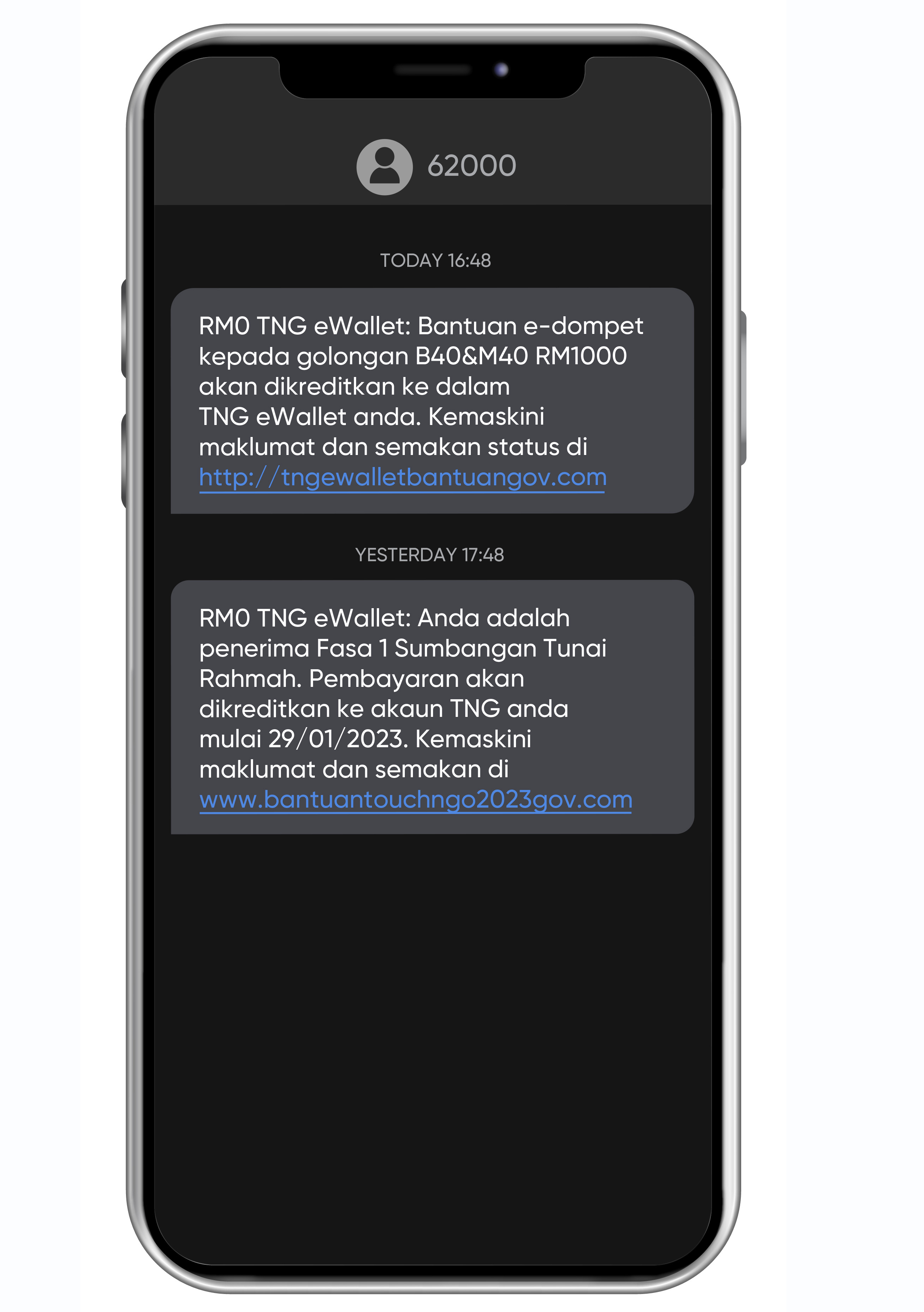

3. Be extra careful and vigilant with links and emails.

Avoid clicking on suspicious links or opening email attachments or SMS from unknown sources that offer you ‘too good to be true’ deals or ‘urgent’ messages that require your immediate attention, which might cause you to be impulsive and click. Instead, remain calm and mark such messages as spam or phishing. By doing so, you can move them from your Inbox to the Spam folder and potentially prevent similar messages from reaching your Inbox in the future. For SMSes, you can just delete them.

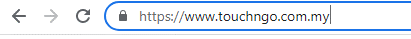

4.Double-check website URLs

When accessing your eWallet account through a website, ensure that the spelling for the URL is correct. These days scammers can create websites to look like the original ones including URLs that start with "https://" and has a padlock icon, for example, "https://www.touchng0.com.my" instead of https://www.touchngo.com.my

5. Be wary of unsolicited communications

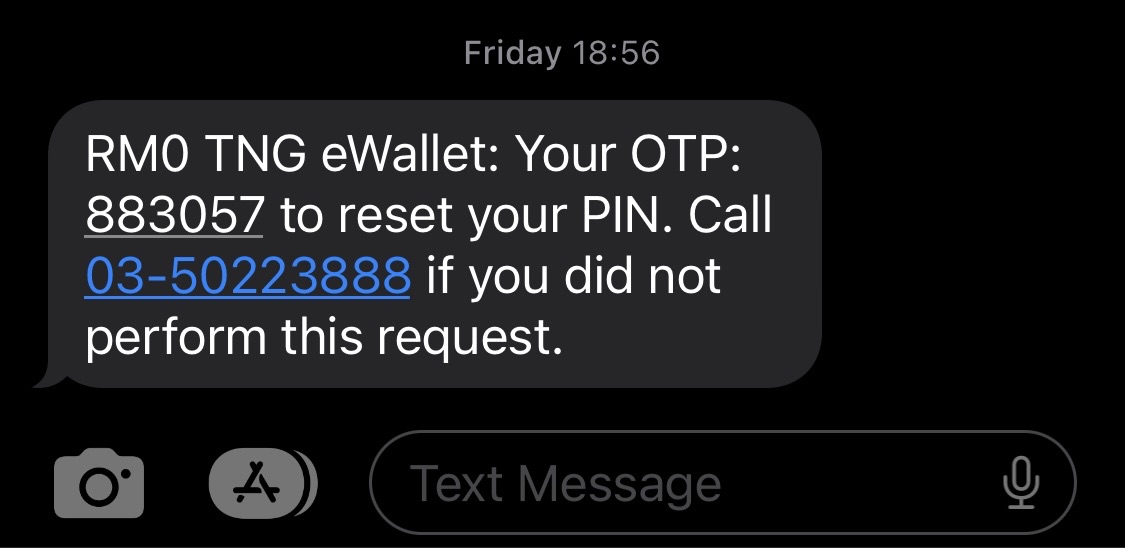

Avoid sharing your personal information or account details in response to unsolicited calls, emails, or messages. Scammers will usually ask for your OTP number to log into your eWallet. The OTP number is one of the security steps that will be sent to you for verification to login and it is not meant to be shared with anyone. Our staff will not ask for sensitive information.

6. Enhance your awareness of common scams.

Stay updated on the latest scams that target eWallet users. This knowledge will empower you to identify and evade potential threats. Be knowledgeable and vigilant in recognising potential threats adds even greater strength to our collective security.

Conclusion

By following these essential tips, you can stay one step ahead of scammers and protect yourself. If you ever receive suspicious calls, emails, or SMS from individuals claiming to be associated with our eWallet service, we urge you to report it to us immediately. Our dedicated support team is here to assist you. For further peace of mind, we have WalletSafe for any unauthorised transactions on verified eWallet accounts.

With your awareness, vigilance, and our combined security efforts, we can create a safer digital environment for everyone. Together, let's outsmart the scammers and enjoy the convenience and security that eWallets provide.

Also read: BNM implement 5 key measures to fight financial scams