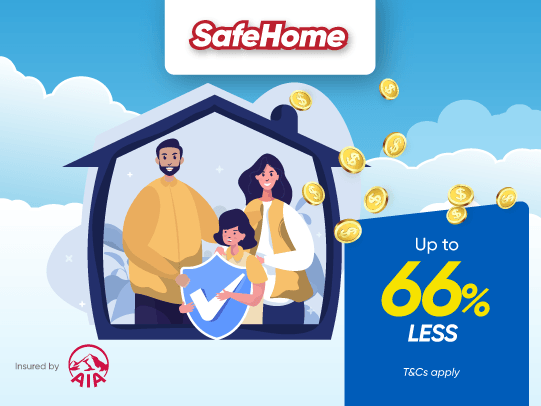

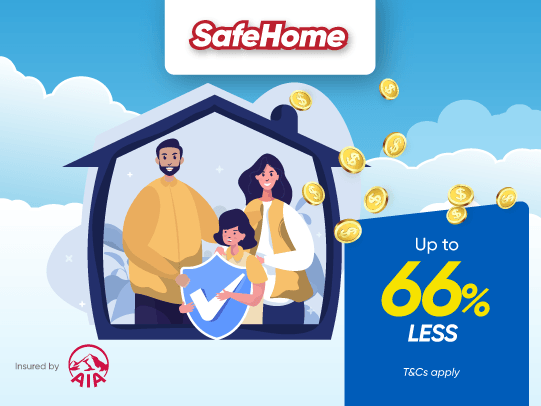

Up to 66%* less on your premium when you protect your home with SafeHome

Enjoy an affordable fire insurance plan for your home that gives you the freedom & flexibility to customise your coverage

Enjoy an affordable fire insurance plan for your home that gives you the freedom & flexibility to customise your coverage

*As of 1 Oct 2022, compared to tariff rated for houseowner insurance

*Tariff Basic Fire insurance and Houseowner insurance are the different types of fire insurance coverage available for home. Tariff Basic Fire insurance covers your building and/or contents from loss or damage caused by fire and lightning. The coverage could also be extended to include flood, subsidence, landslip and other events. Tariff Houseowner insurance provides additional coverage compared to Tariff Basic Fire insurance to cover your building and it comes with a higher premium than Tariff Basic Fire insurance.

Pay up to 66%* less premium as compared to tariff rates for Householder insurance.

Save more by customising your add-ons and pay for only what you need

RM2,000 cash relief

RM5,000/person medical coverage for up to 2 people

Covers damages to the building and/or content against Fire & Lightning

Save time & money by easily cancelling your existing policy with our FREE cancellation note

Full refund within 60 days from policy start date if you are unable to terminate your existing policy with the bank.